Income & Expense Verification

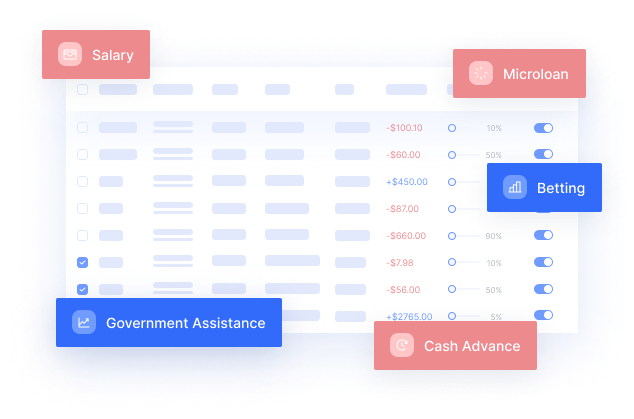

Our market-leading categorisation engine features over 240+ Expense and 32 Income Categories, with the ability to create custom categories to suit your needs.

Build better lending models with greater accuracy to make faster lending decisions

Manual credit assessment processes make it difficult for lenders to make fast, informed lending decisions with many struggling to get an accurate and up-to-date picture of their customer’s financial health.

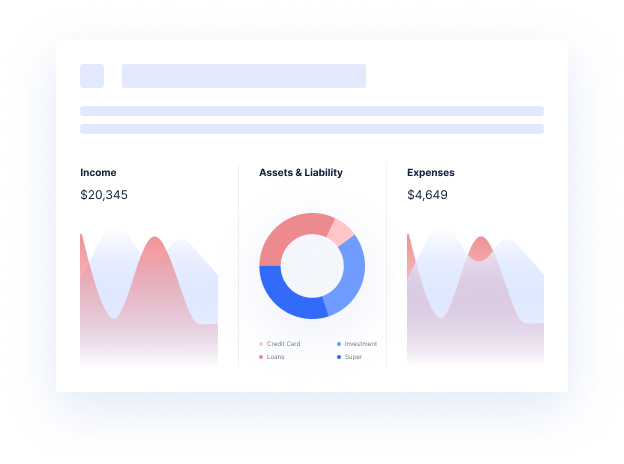

Finch's affordability solution provides lenders with real-time insights around income, assets, liabilities and high risk spending behaviour to reduce credit risk and meet the demands for online lending.

Our market-leading categorisation engine features over 240+ Expense and 32 Income Categories, with the ability to create custom categories to suit your needs.

With clean and categorised data, our advanced analytics generates in-depth profiling and behavioural patterns across discretionary, non-discretionary and high risk spending, giving assessors the tools they need to ask the right questions.

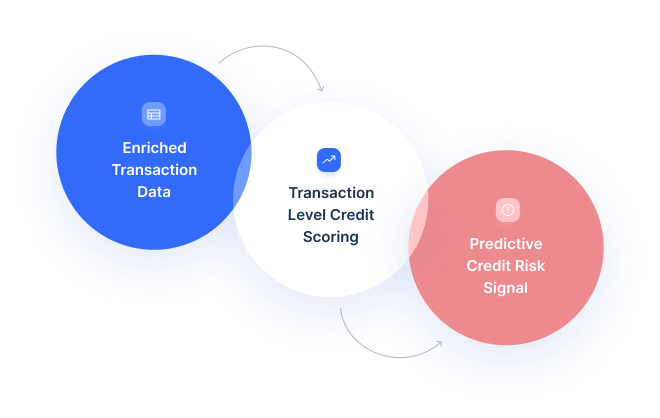

With a full financial picture thanks to accurate transaction data, lenders can support transaction level credit scoring and improved lending models to reduce risk and make faster lending decisions.

Our powerful enrichment engine uses the latest data modelling methodologies, tested against hundreds of millions of new transactions every month to continuously improve its accuracy.

Learn moreWith deep experience in CX, financial analysis and data engineering, we spend time understanding your data challenges to help you get the most out of your data

Learn moreAccelerate speed to market by leveraging our machine learning algorithms trained on over $30 billion worth of transaction data and behavioural patterns.

Learn moreOur intelligence reports provide real-time consumer and retail insights that power data-driven decisions across sales, business and operations.

Learn more