About Finch

Finch is an independent data intelligence platform powering personalisation across Australia.

Finch products

Turn transaction data into clean and categorised insights for a real-time view of your customer's financial position.

Finch is an independent data intelligence platform powering personalisation across Australia.

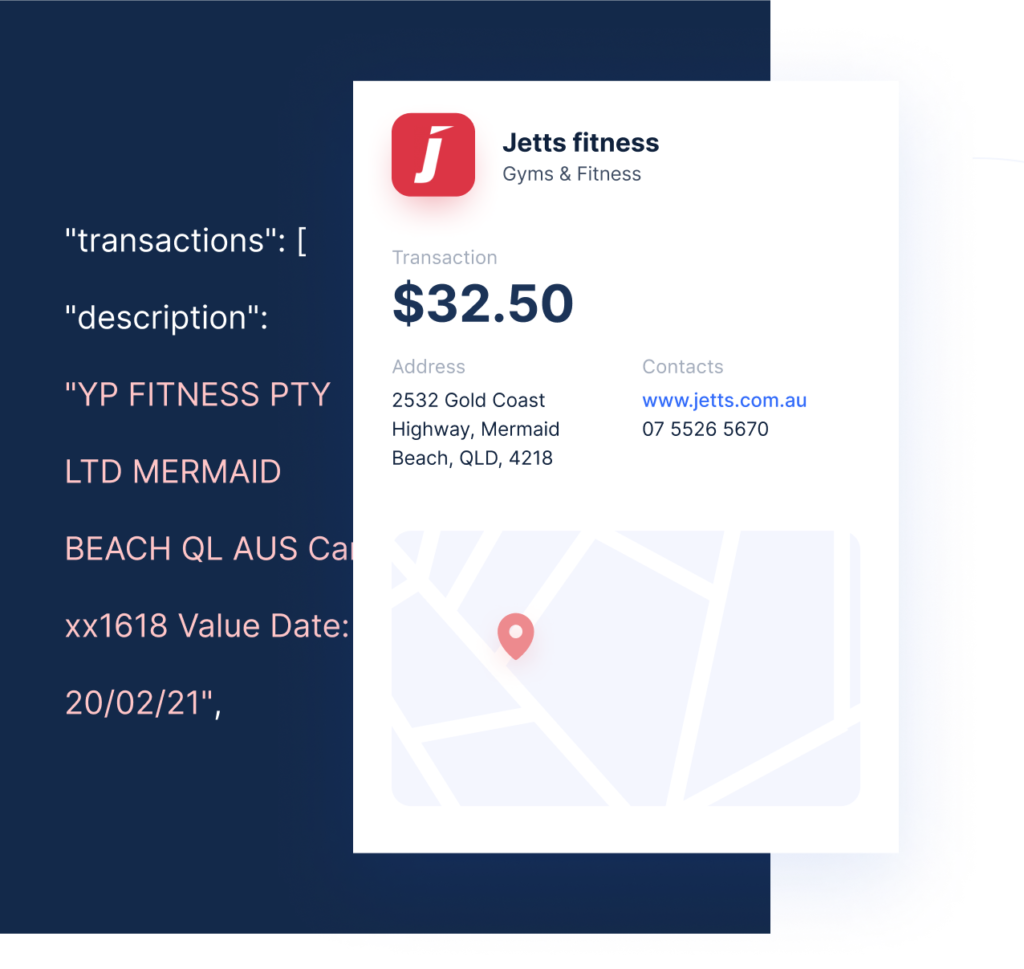

Transaction data provides a rich source of real-time customer insights, however the lack of standardisation across banks makes raw data difficult to understand and analyse.

Finch Enrichment delivers clean and categorised data in seconds. Whether you’re bulding a PFM, digital bank or lending solution, our high quality data helps you understand your customer's financial behaviour in real-time.

Identifies over 1.5m+ merchants including PTY LTD. Over 25,000 merchant logos available.

Over 240+ Expense categories including BNPL, Debt Collection Services, Betting & Lotteries

Street address, suburb and postcode to enable geolocation spending insights

32 Income categories including Salary & Wages, Government Financial Assistance, Microloans

Service-level accuracy guarantees for:

A single API integration to access our entire range of data intelligence tools

Merchant Name

Location

Category

Logo & Website

Income Verification

Fee Saver

Bill Analyser

Reward Spending

Consumer spending

Retail anaytics

Industry insights

Customer Profiling

Use Enrichment in your PFM app to deliver beautiful UI and help customers better understand their spending behaviours.

Learn moreUse Enrichment for advanced income and expense categorisation for real-time risk assessment.

Learn moreCutting edge AIML intelligence with privacy and security at its core.

Our ASAE-3150 assurance report covers all of the Schedule 2 security requirements, including over 24 prescribed security controls under CDR such as multi-factor authentication, firewalls, protections against malware and data leakage, user access and systems monitoring.

Our physical infrastructure is hosted and managed on Sydney-based servers in ISO 27001, SOC 1 & SOC 2, and PCI Level 1 certified data centres.

Customer data enters through our REST APIs (using HTTPS) and encrypted-in-transit using the SSL/TLS protocol. Data at rest is encrypted using 256-bit Advanced Encryption Standard (AES-256).

Firewalls are utilised to restrict access to systems from both external networks and internal systems. Administrative access within our systems and to customer data is restricted and requires physical multi-factor authentication keys and strong password controls.

Our powerful enrichment engine uses the latest data modelling methodologies, tested against hundreds of millions of new transactions every month to continuously improve its accuracy.

Learn moreWith deep experience in CX, financial analysis and data engineering, we spend time understanding your data challenges to help you get the most out of your data

Learn moreAccelerate speed to market by leveraging our machine learning algorithms trained on over $30 billion worth of transaction data and behavioural patterns.

Learn moreOur intelligence reports provide real-time consumer and retail insights that power data-driven decisions across sales, business and operations.

Learn more