Enrich

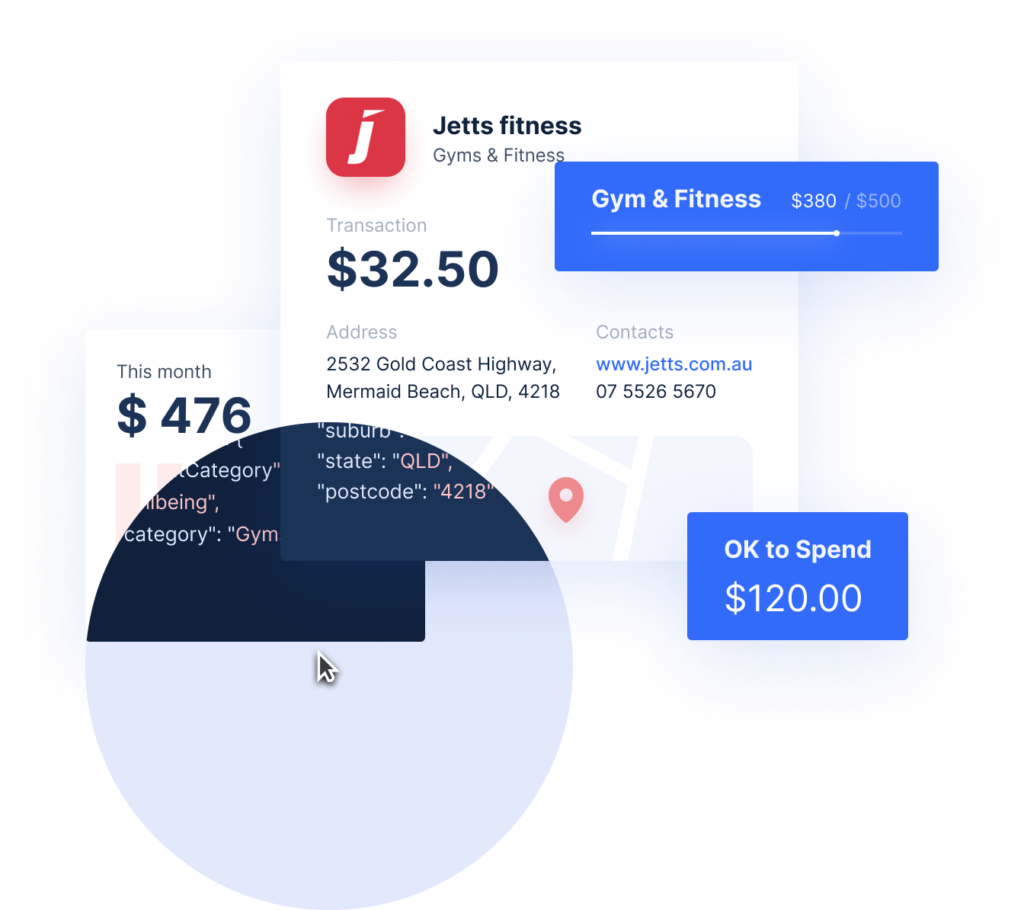

Our AIML platform ingests and enriches raw transaction data in real-time, delivering merchant name, location and logos with over 95% accuracy.

Create highly personalised and contextual experiences based on real-time financial behaviour.

Transaction data provides a rich source of real-time customer insights, however the lack of standardisation across banks makes raw data difficult to understand and analyse.

Finch Financial Wellness transforms raw transaction data into actionable insights so you can better understand your customer's financial position and create seamless personalised journeys to help them achieve their goals.

Our AIML platform ingests and enriches raw transaction data in real-time, delivering merchant name, location and logos with over 95% accuracy.

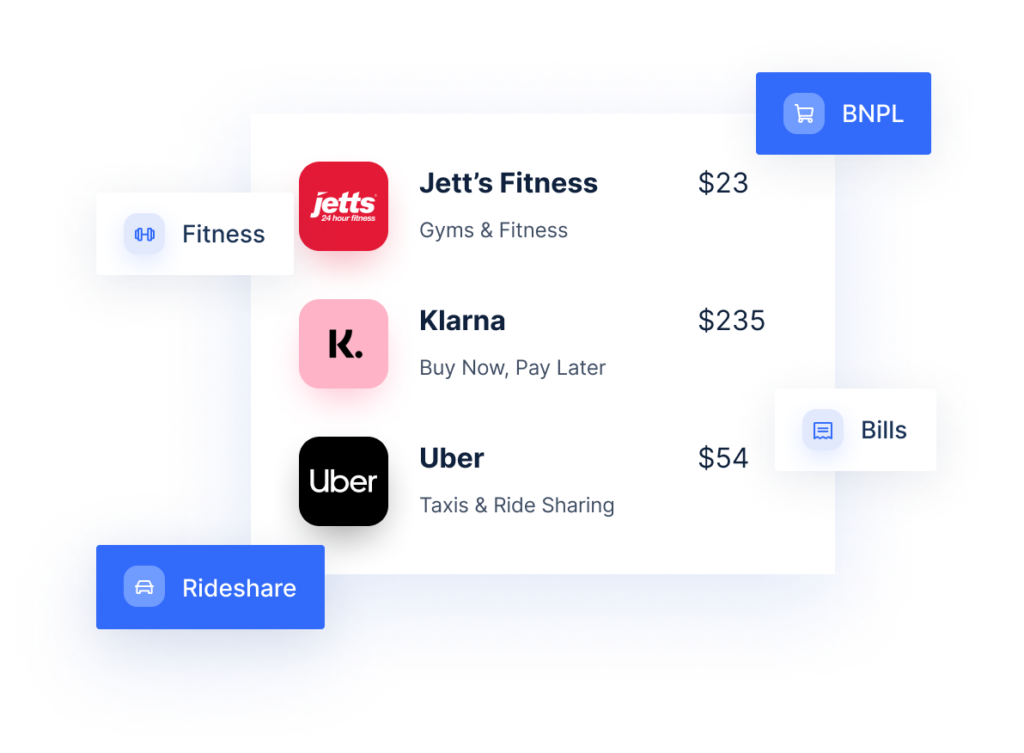

Transactions are categorised across 240 income and expense categories, including 30+ bank fees such as Cash Advance Fees and Late Payment Fees.

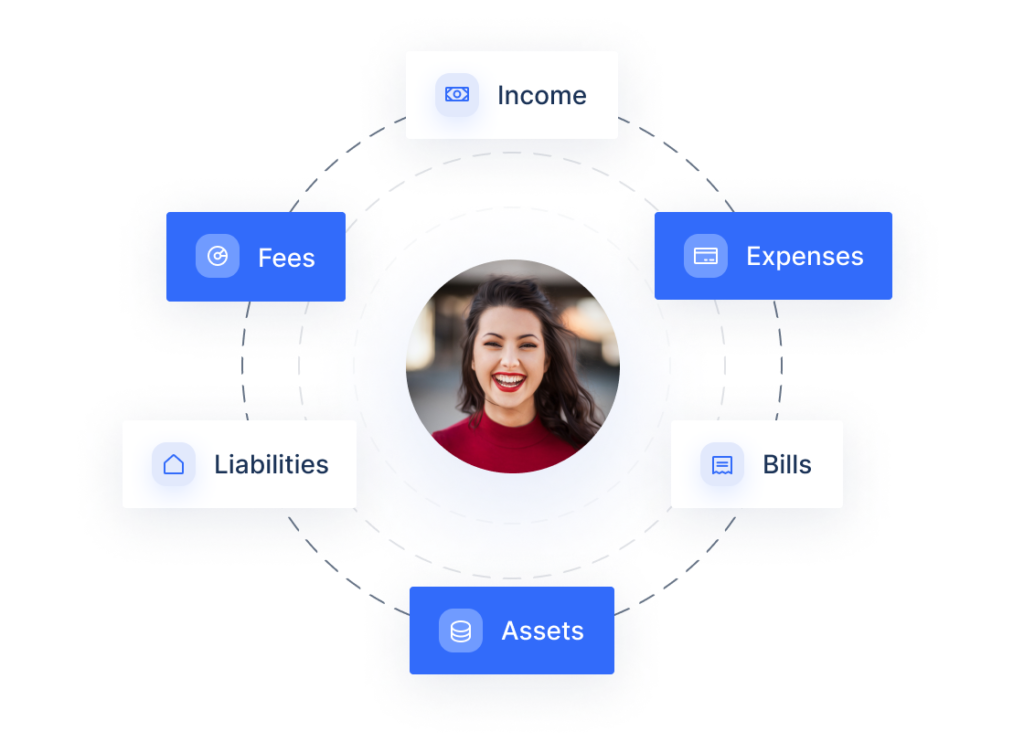

Machine learning algorithms analyse a customer's behavioural patterns across pay cycles, expenses, bills, fees and more for an in-depth analysis of your customer's financial health.

With a clean and accurate 360 view of your customer's finances, PFMs can create personalised and predictive financial experiences that are intuitive and engaging.

Our powerful enrichment engine uses the latest data modelling methodologies, tested against hundreds of millions of new transactions every month to continuously improve its accuracy.

Learn moreWith deep experience in CX, financial analysis and data engineering, we spend time understanding your data challenges to help you get the most out of your data

Learn moreAccelerate speed to market by leveraging our machine learning algorithms trained on over $30 billion worth of transaction data and behavioural patterns.

Learn moreOur intelligence reports provide real-time consumer and retail insights that power data-driven decisions across sales, business and operations.

Learn more