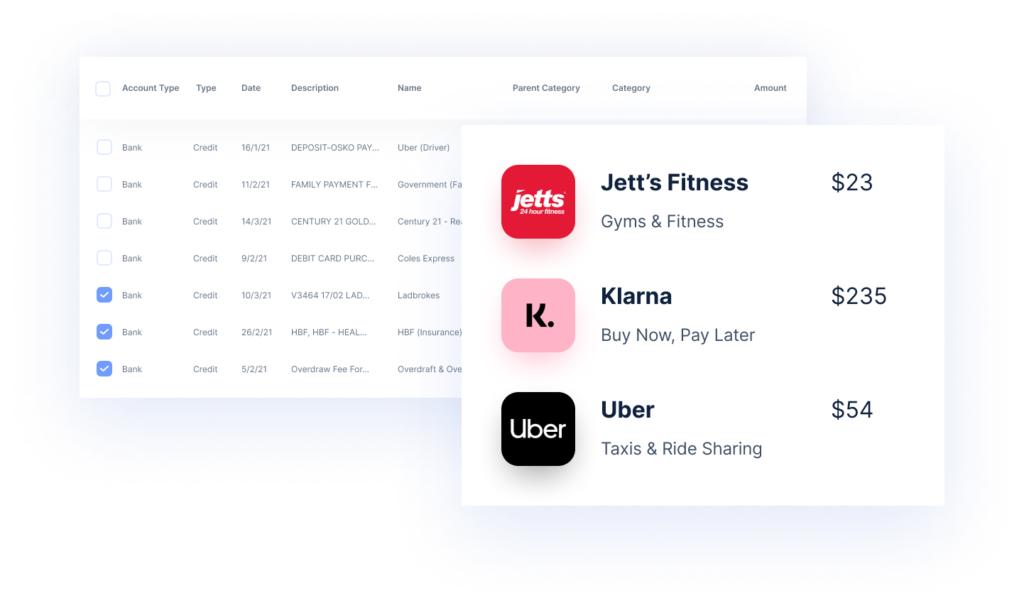

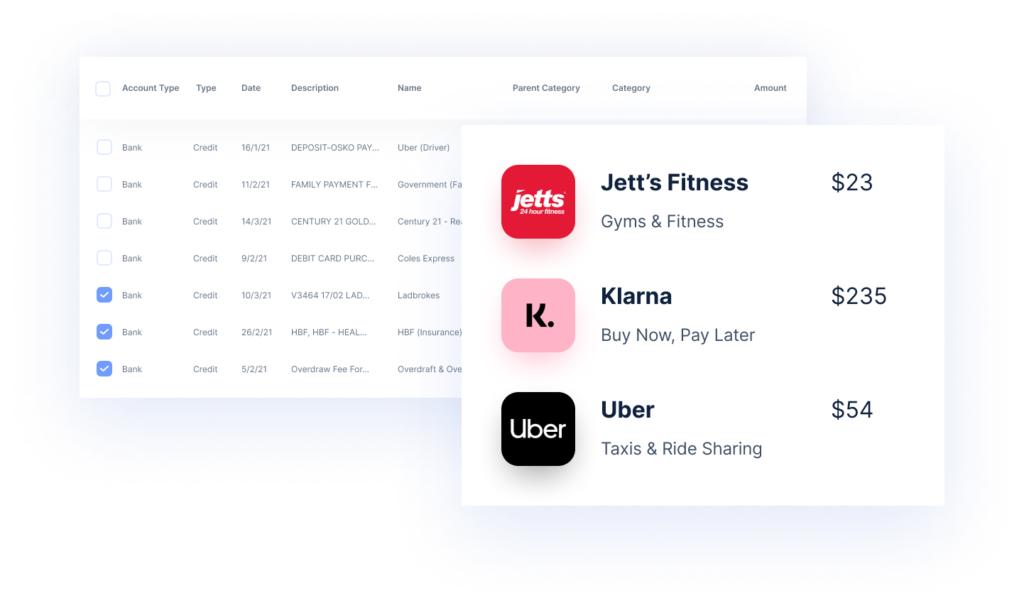

Categorise

Our AIML platform ingests and enriches raw transaction data in real-time, delivering merchant name, location, category and logos with over 95% accuracy.

Real-time categorisation and AIML analytics to help you deliver on your personalisation promise

With the arrival of Open Banking, customer demand for personalised experiences are at an all-time high, however raw transaction data remains difficult to analyse due to lack of standardisation and enrichment.

Finch's Open Banking solution provides real-time categorisation, AIML analytics and intelligence in a single API. Transform raw Open Banking data into rich insights to create competitive personalisation strategies.

Our AIML platform ingests and enriches raw transaction data in real-time, delivering merchant name, location, category and logos with over 95% accuracy.

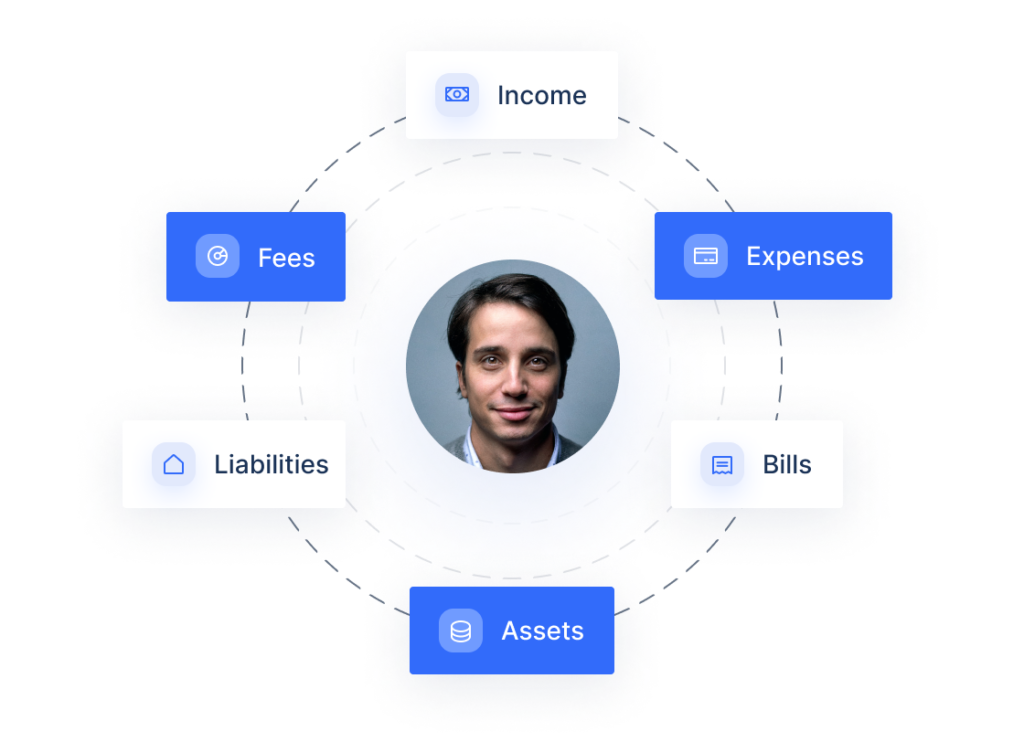

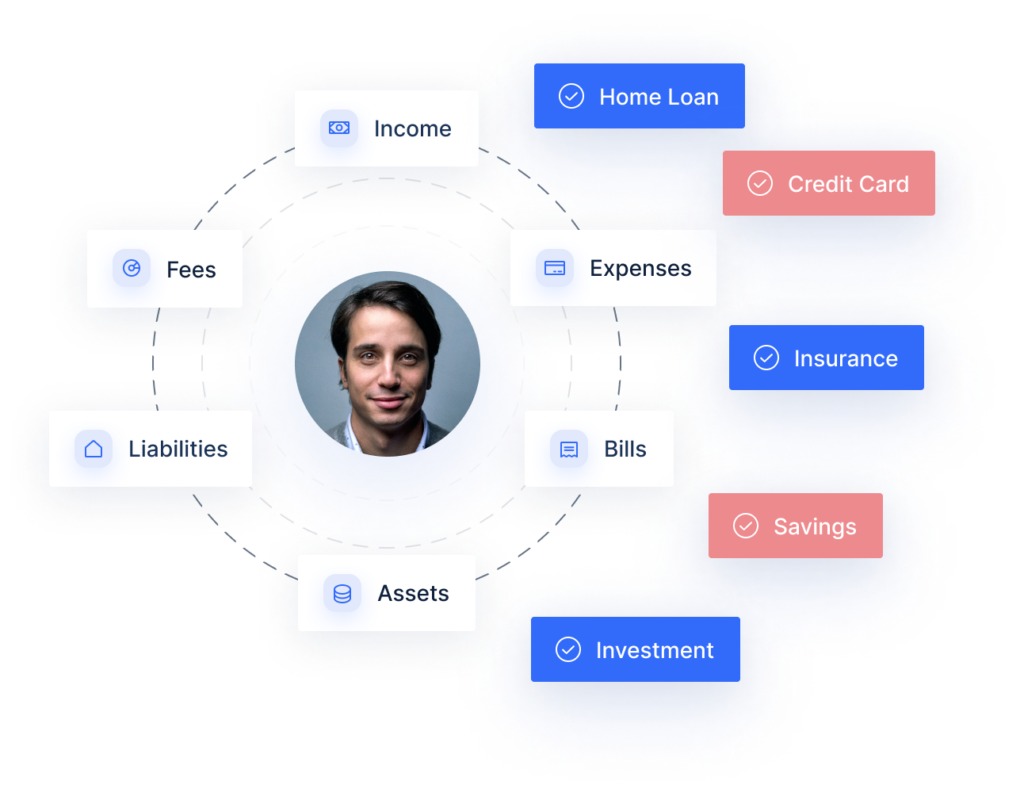

Machine learning algorithms analyse a customer's behavioural patterns across pay cycles, expenses, bills, fees and more for an in-depth analysis of your customer's financial health.

With an accurate and detailed understanding of a customer’s real-time financial circumstances, Accredited Data Recipients now have the ability to create competitive products, services and offers that are best suited to a customer’s financial needs.

Our powerful enrichment engine uses the latest data modelling methodologies, tested against hundreds of millions of new transactions every month to continuously improve its accuracy.

Learn moreWith deep experience in CX, financial analysis and data engineering, we spend time understanding your data challenges to help you get the most out of your data

Learn moreAccelerate speed to market by leveraging our machine learning algorithms trained on over $30 billion worth of transaction data and behavioural patterns.

Learn moreOur intelligence reports provide real-time consumer and retail insights that power data-driven decisions across sales, business and operations.

Learn more